Payroll calculator with overtime and taxes

Ad Payroll So Easy You Can Set It Up Run It Yourself. For all employees with a 401k FSA account or anything along those lines that are exempt from payroll tax subtract any contributions they make from gross wages before.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

All hours exceeding the.

. You can pay taxes online using the EFTPS payment system. Please fill out the form to receive a free copy of our South Korea payroll taxes and benefits guide. Choose Tax Year and State.

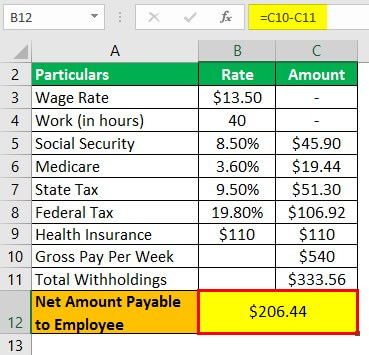

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Overtime work must conform to the maximum working hours stipulated within the employee contractcollective agreement etc. The employer must pay.

For night-time overtime between the hours of 9 pm and 4 am overtime is calculated at 12500 of the regular salary rate. Payroll taxes are taxes employers pay on behalf of their employees. Learn about employment payroll and immigration for Colombia to help your company with local legislation.

The paycheck calculator is designed to estimate an employees net pay after adding or deducting things like bonuses overtime and taxes. Its a high-tax state in general which affects the paychecks Californians earn. Ad Compare This Years Top 5 Free Payroll Software.

Daytime Overtime is paid at 12500 of the regular pay rate. The 2022 rates range from 03 to 142 on the. Net pay would deduct taxes Social Security Medicare local state and federal taxes health insurance and retirement savings 401K and IRA from your paycheck.

If the employee works overtime and is nonexempt multiply the hourly rate by 15 or the rate according to the overtime rules by state to get the overtime rate. South Carolina State Payroll Taxes. Choose your state below to find a state-specific payroll calculator check 2022 tax rates and other local information.

Overtime Calculator More - Free. Please keep in mind that this calculator is not a one. As an employer in Arkansas you have to pay unemployment insurance to the state.

There are two common types of overtime. These maximums are 48 hours a week. Employment cost calculator.

Use our easy payroll tax calculator to quickly run payroll in West Virginia or look up 2022 state tax rates. In Spain minimum wages are fixed per industry sector in the collective bargaining agreements. First and foremost we have to take care of Uncle Sam.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Annual overtime cannot exceed 150 hours. Please fill out the form to receive a free copy of our Singapore payroll taxes and benefits guide.

Payroll Taxes Taxes Rate Annual Max Prior YTD CP. Ad Find 10 Best Payroll Services Systems 2022. However in general the minimum wage used in Spain is 965 EUR per month.

It can also be used to help fill steps 3. According to the Small Business Association 992 of businesses in California are classified as small businesses Whether you run an ice cream. Employment cost calculator.

Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required. When an employee is requested to work overtime or work on holidays there are maximums in relation to the number of hours allowed. Our handy payroll calculator can help you figure.

Its a progressive income tax meaning the more. We want you to create an awesome small business without having. Free Unbiased Reviews Top Picks.

You will need to use Form 941 to file federal taxes quarterly and Form 940 to report your annual FUTA tax. If they worked any overtime hours make sure to calculate those. Ad Run your business.

Now that were done with federal taxes lets look at South Carolina state income taxes. Well run your payroll for up to 40 less. The maximum overtime hours are 48 hours per working week.

With 15000 for any other time. Get your payroll done right every time. The exact amount of tax is determined by each employees salary wage and tips.

Ad Payroll So Easy You Can Set It Up Run It Yourself. All Services Backed by Tax Guarantee. All Services Backed by Tax Guarantee.

Affordable Easy-to-Use Try Now. This lets us find the most appropriate writer for any type of. It does calculate net pay.

Ad Compare This Years Top 5 Free Payroll Software. Free Unbiased Reviews Top Picks. Big on service small on fees.

Check out your states payroll taxes below. Arkansas State Unemployment Insurance. Overtime is due after working the maximum hours of 45 hours in.

Along with payroll-related taxes and withholding New York employers are also responsible for providing employees with State Disability Insurance SDI to cover off-the-job. The Golden States income tax system is progressive which means wealthy filers pay a higher marginal tax rate on.

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

How To Calculate Payroll Taxes Methods Examples More

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator Take Home Pay Calculator

Payroll Tax Calculator For Employers Gusto

Payroll Calculator Free Employee Payroll Template For Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Payroll Formula Step By Step Calculation With Examples

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Formula Step By Step Calculation With Examples

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Overtime Calculator