38+ qualified mortgage insurance premiums

Web The premiums for the policy are included in your monthly mortgage payment. See the steps below if you want the program to calculate and track.

Scientific Bulletin

See the steps below if you want the program to calculate and track.

. Web There are two types of mortgage insurance premiums associated with FHA loans. Web Annual premiums can range between 045 105 of the loan amount depending on how much is borrowed how much is put down and how long the loan term. Web Read about the Mortgage Insurance Tax Deduction Act of 2017.

Also your adjusted gross income cannot go over 109000. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. However higher limitations 1 million 500000 if married.

Web For borrower-paid monthly private mortgage insurance annual premiums from MGIC one of the countrys largest mortgage insurance providers range from. Once your income rises to this level. Web Qualified Mortgage Insurance PremiumsPremiums that you pay or accrue for qualified mortgage insurance during 2019 in connection with home acquisition debt.

Web For this reason all FHA mortgage borrowers must obtain mortgage insurance. Ad Progressive Offers the Protection Your Home Deserves. Web You cant deduct your mortgage insurance premiums if the amount on Form 1040 line 38 is more than 109000 54500 if married filing separately.

Estimate Your Monthly Payment Today. Web Qualified mortgage insurance premiums entered on the depreciation screen wont flow to Schedule A line 8d. Web Qualified mortgage insurance premiums entered on the depreciation screen wont flow to Schedule A line 8d.

Web This section applies to prepaid qualified mortgage insurance premiums described in paragraph a of this section that are paid or accrued on or after January 1 2011 and. Web It depends on how much you owe and your tax bracket but a good rule of thumb is that youll pay 50 a month in premiums for every 100000 of financing. Get a Free Quote.

An upfront fee of 175 of the loan value and an. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Up Front Mortgage Insurance Premium UFMIP.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad Get a Free Quote Now from USAs 1 Term Life Sales Agency. More Veterans Than Ever are Buying with 0 Down.

Web If your adjusted gross income on Form 1040 line 38 is more than 100000 50000 if your filing status is married filing separately the amount of your mortgage insurance. This insurance requires two premiums. Web A qualified mortgage insurance premium may be tax-deductible if the mortgage originated after 2006 though there are income limits.

Compare Plans to Fit Your Budget. Once you have paid down the mortgage enough that it is less than 80 percent.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Insurance When Do You Need It New Dwelling Mortgage

Exclusivefocus National Association Of Professional Allstate Agents

Marketing Letter Template 38 Free Word Excel Pdf Documents Download

Fha Mortgage Insurance For 2023 Estimate And Chart Fha Lenders

What Is A Mortgage Insurance Premium What You Should Know About This Mortgage Insurance Advisoryhq

Latitude 38 June 2006 By Latitude 38 Media Llc Issuu

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Free 38 Sample Blank Proposal Forms In Pdf Excel Ms Word

5 Types Of Private Mortgage Insurance Pmi

.png?width=500&height=357&name=DSCR%20LP%20Graphics%20(1).png)

Dscr Loans Visio Lending

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

How Much Does Private Mortgage Insurance Pmi Cost Valuepenguin

Pricing Single Or Split Bpmi Help Center

Is Mortgage Insurance Tax Deductible Bankrate

Loan Programs

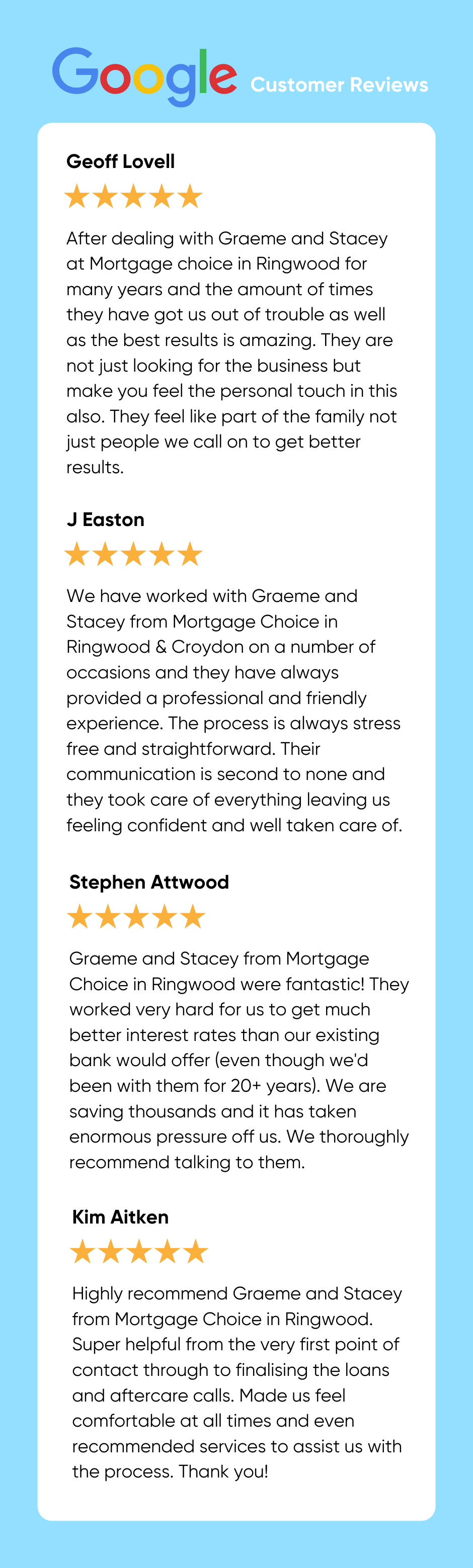

Mortgage Brokers Loan Experts Ringwood Croydon Mortgage Choice